BOUTIQUE PROPERTY ADVISOR & HOTEL ESG consultants

ESG CERTIFIED CONSULTANT FOR HOTELS & PROPERTIES

As a real estate consulting firm, we offer wellbeing and sustainability consulting services as well as advice for smaller funds and boutique real estate developers on establishing an ESG strategy to align with global benchmarks and annual reporting standards

What is Environmental, Social & Governance (ESG) for real estate & hotels?

Top real estate advisory firms will all work to align a real estate developer’s business with UN Sustainable Development Goals; Net Zero Carbon targets; Circular Economy principles; healthy building products; Life Cycle Assessments; diversity, equality and inclusion principles; employee & workplace satisfaction; community outreach; social enterprises; stakeholder engagement; mental health programs; energy, water and waste data; governance policies and health & safety.

Our special sauce as one an extremely efficient, specialist ESG consulting firms UK lies in our combination of in-house green building and healthy building expertise. We are a lean, agile team on each of our ESG consultancy service assignments covering the entire process for our clients and their featured properties.

Environmental Policy / Real Estate ESG

photo: Hero natural foods group /Daniel Werder - we played a biophilic design / workplace wellness advisory role

A real estate investment development fund environmental policy covers sustainable site selection criteria; embodied carbon emissions disclosure; green & healthy materials selection; Life Cycle objectives; location & transportation objectives; water conservation policy; waste management policy; supply chain objectives; minimum energy efficiency requirements; on-site renewable energy guidance and green building standard certifications.

Strategic real estate consultancy with a sustainability angle is focused primarily on environmental resources management, whereas ESG sustainability consulting services for boutique real estate development funds require a wider perspective that balances the ‘E’ with Social and Governance concerns into one cohesive strategy.

Social Policy / Real Estate ESG

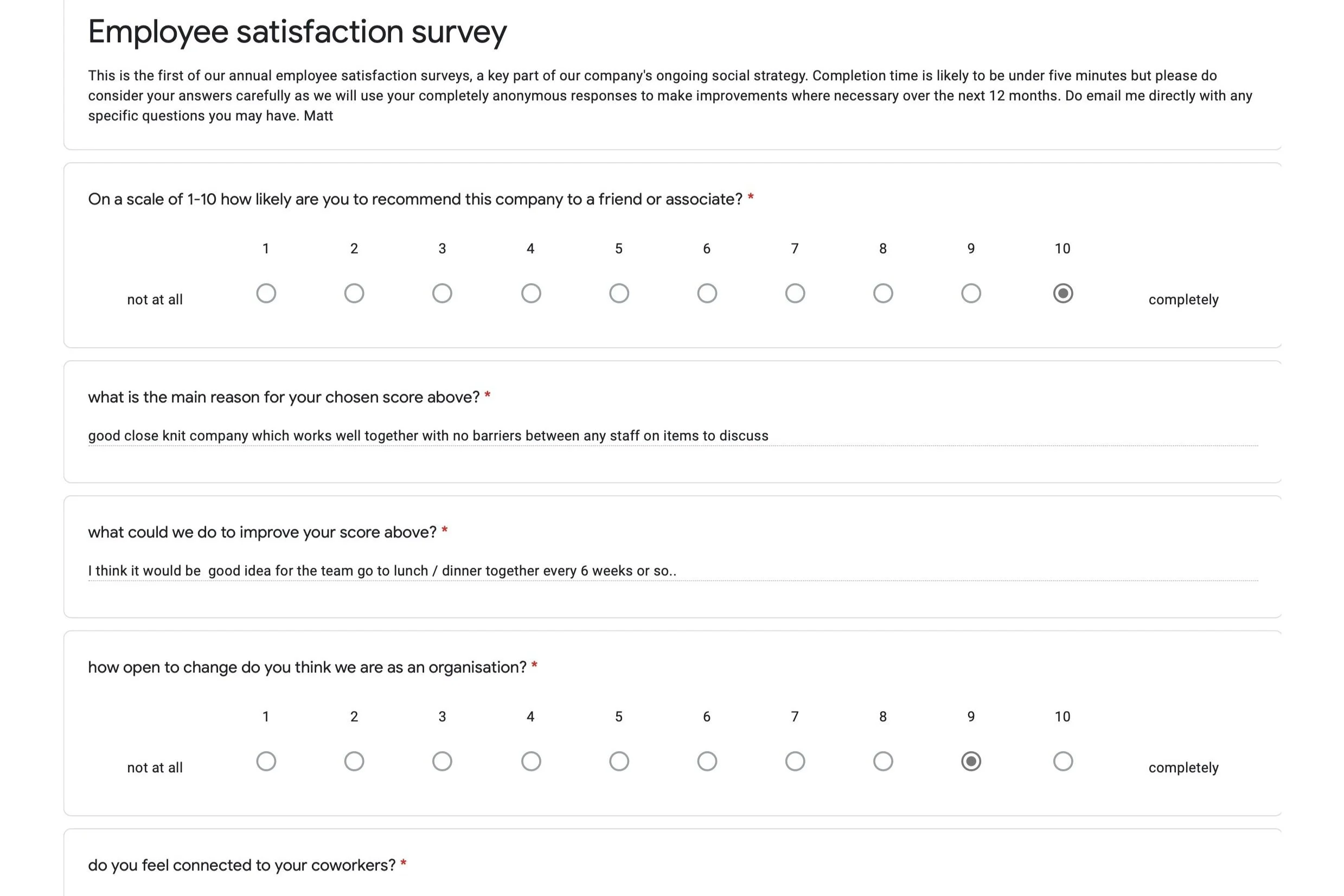

A real estate fund ESG strategy needs a solid Social Policy composed of occupant health and wellbeing (indoor air quality, thermal comfort, ergonomics, light, biophilia, fitness); social enterprise partnerships; employee surveys & engagement programs; health & safety objectives; a diversity & inclusivity plan; ethical supply chain measures; on-site safety monitoring; socio-economic impact analysis of new developments, community outreach initiatives and buildings in the portfolio with healthy building standard certifications.

While most top real estate consulting firms UK will have some exposure to implementing a Social policy on the front lines of a hotel or residential real estate development for example, we really double-down on human health and wellbeing strategies.

Governance Policy / Real Estate ESG

A real estate ESG governance policy will cover anti-corruption and bribery; disciplinary procedures; IT and communications systems policy; privacy standards and whistleblowing procedures.

In addition to extensive stakeholder engagement, a number of appropriate ESG policies and charters will need to be adopted, from an internal ESG task force and an ESG senior decision-maker, ESG performance targets for relevant personnel; incident monitoring, risk management and stakeholder engagement.

Real estate ESG frameworks

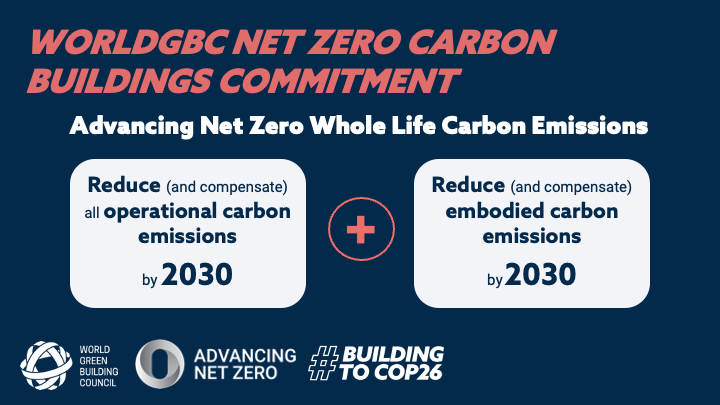

From the UN Sustainable Development Goals (UN SDGs) down, there are ESG frameworks and tools available to us as ESG real estate consultants such as SASB (sustainability accounting); Task Force on Climate Related Disclosures (TFCD) on climate related information and financial risks; Climate Disclosure Project (CDP) an environmental impact disclosure system and the Net Zero Carbon Buildings Commitment for decarbonization of the built environment.

Every property requirements are different, just like all clients’ needs, so we aim to provide neutral, honest advice to assist in making the ESG investment, rather than taking a sales-led attitude it’s about finding what’s best suited to each project.

Real estate ESG management software

As real estate ESG consultants we are responsible for delivering the annual report reviewing the work done during the year but it is the ongoing ESG management, policy creation, and incremental progress that really matters.

Producing reliable ESG and sustainability data ensures alignment with the appropriate policies and ESG frameworks.

Dedicated ESG software helps us to track, visualize and monitor what is going on.

GRESB Real Estate Benchmark Assessment

GRESB is a real estate ESG assessment and benchmarking tool for the performance of real (i.e. physical building) assets, providing standardized and validated data to institutional investors, fund managers, companies and funds investing in the real estate sector.

It has recently established itself as the leading benchmark assessment for real estate developers and landlords.

ESG real estate annual reports

GRI Standards for Construction & Real Estate provide a global benchmark for sustainability reporting on a property company’s impact on economy, environment and people.

Annual ESG reports follow the GRI content guidelines and indexing to ensure enhanced credibility, transparency and user-friendliness for stakeholders.

Biofilico Founder: Matt Morley

esg certified consultant

A real estate development fund may appoint a Head of ESG or outsource this role to an ESG consultant.

The role includes engaging with green building and/or healthy building standards at property level while driving the Environmental, Social & Governance agenda internally at corporate level by implementing processes and protocols, stakeholder engagement plans, data collection, ESG management software, an annual ESG standard submission and ESG report.

journal articles related to real estate esg and sustainability

ESG consultant services

Our role as real estate ESG advisors combines both macro-level strategy and tactical quick wins, all backed by a cohesive plan that integrates global benchmarks in real estate sustainability excellence with company and location specific inputs.

What does a real estate ESG consultant do?

As advisors in real estate ESG plans we combine expert knowledge in wellness interiors real estate, healthy buildings, real estate sustainability and specific ESG benchmark certification standards as well as a decade of in-house development experience.

How long does it take to prepare a real estate ESG annual report?

These real estate ESG reports typically require a couple of months at the end of the 12-month in question to collate and synthesize the appropriate texts, infographics and accompanying images together before designing a professional, investor-friendly report that can be published in digital format online for transparency purposes.